Economic Review – November 2025

| ONS data reveals the UK economy barely expanded across Q3, with the economy contracting by 0.1% in September alone | The Monetary Policy Committee voted to leave Bank Rate on hold by a 5–4 majority in November | The headline index from last month’s GfK consumer confidence survey fell two percentage points |

OBR downgrades UK growth forecasts

New projections from the Office for Budget Responsibility (OBR) predict the UK economy is set to grow at a slower rate than previously expected.

The independent fiscal watchdog’s latest economic assessment was produced for the Autumn Budget which Chancellor Rachel Reeves delivered on 26 November. During her speech, the Chancellor noted that the OBR had increased this year’s growth estimate to 1.5% from March’s figure of 1.0%, with the upgrade reflecting stronger-than-expected activity during the first quarter of the year.

Over each of the remaining five years of the forecast period, however, the updated figures suggest the economy will grow by 1.5% on average, a 0.3 percentage point reduction from the OBR’s previous assessment due to reduced expectations for productivity growth.

Prior to the Budget, Office for National Statistics (ONS) data revealed that the UK economy barely expanded across the third quarter, with the economy actually contracting by 0.1% in September alone. While this latter figure was impacted by a marked decline in motor vehicle production due to the Jaguar Land Rover cyber-attack, the data did confirm the sharp slowdown in activity that has been evident as the year has progressed.

Survey evidence also highlights a more recent loss of momentum with the preliminary headline growth indicator from the latest S&P Global UK Purchasing Managers’ Index (PMI) falling from 52.2 in October to 50.5 last month; this reading was below all predictions in a Reuters poll of economists.

S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said November’s survey suggests the economy “has stalled,” with the flash data implying “a meagre 0.1%” quarterly pace of growth in the fourth quarter so far. While acknowledging that some of the malaise may have been caused by delayed spending ahead of the Budget, Mr Williamson added there was “a real chance this pause may turn into a downturn.”

Interest rates held; but more cuts expected

Although last month did see the Bank of England (BoE) maintain interest rates at their current level of 4.0%, a tight vote and policymaker comments after the announcement suggest further rate cuts are likely in the coming months.

At its latest meeting, which concluded on 5 November, the BoE’s Monetary Policy Committee (MPC) voted to leave Bank Rate on hold by a 5–4 majority, with all four dissenting voices preferring to see an immediate quarter-point reduction. This close vote, along with signs that BoE Governor Andrew Bailey might be persuaded to switch allegiance and join those seeking a cut, however, did raise the prospect of further easing soon.

Speaking after announcing the decision, Mr Bailey reiterated his view that Bank Rate remains on a “gradual downward path.” He also suggested current market pricing – which implies two or three quarter-point cuts by the end of next year – was a “reasonable view” for the future path of interest rates. Despite feeling inflation has now peaked, though, the Governor said he saw “value in waiting for further evidence” of slowing price growth before reducing rates again.

Two weeks after the MPC meeting, ONS published October’s official inflation statistics which revealed an annual headline CPI rate of 3.6%. This reading was down from September’s 3.8% figure, with prices in October increasing at their slowest pace for four months, raising hopes that inflation has now peaked.

Analysts typically expect to see a further cooling of inflationary pressures over the next few months, which could then pave the way for more interest rate cuts. Indeed, a recent Reuters poll found that 80% of surveyed economists are now forecasting a quarter-point rate reduction at the MPC’s next meeting on 18 December, with a majority of respondents predicting a similar-sized cut during the first quarter of next year too.

Markets

At the end of November, global stocks ticked higher as Black Friday sales continue to provide support and traders focus on the Federal Reserve’s upcoming December meeting, as hopes of an interest rate cut intensifying. Optimism around AI helped drive tech stocks before the US market closed for the Thanksgiving holiday.

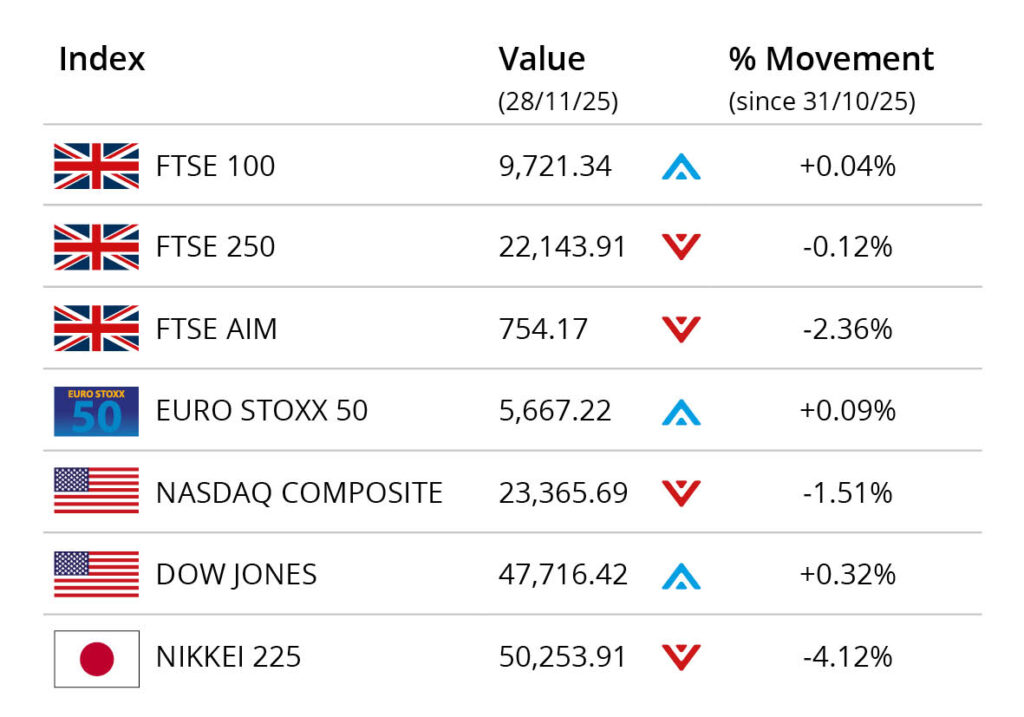

In the UK, the blue-chip FTSE 100 closed the month on 9,721.34, a small gain of 0.04%. The mid-cap FTSE 250 recorded a small loss of 0.12% in November to end on 22,143.91, while the FTSE AIM registered a 2.36% loss to close the month on 754.17. On the continent the Euro Stoxx 50 gained 0.09% during November to close on 5,667.22. In Japan, the Nikkei 225 finished the month 4.12% lower to close on 50,253.91,

The Dow Jones closed the month on 47,716.42, a small increase of 0.32% in the month. The tech-focused NASDAQ closed the month down 1.51% on 23,365.69.

On the foreign exchanges, the euro closed the month at €1.14 against sterling. The US dollar closed at $1.32 against sterling and at $1.15 against the euro.

The gold price rose 5.28% during November, closing at around $4,221 a troy ounce, with expectations of a Fed rate cut in December providing support. Brent Crude closed the month at around $63 a barrel, recording a loss of 1.26% in the month. The oil price recorded a fourth consecutive monthly loss, as over supply concerns weigh.

Jobs market continues to weaken

Official labour market statistics released last month revealed a further cooling in the UK jobs market, with the unemployment rate up, the number of payrolled employees down and wage growth also edging lower.

According to the latest ONS figures, the UK rate of unemployment stood at 5.0% between July to September 2025; this represents a notable jump from a figure of 4.8% across the previous three-month period. The increase was above analysts’ expectations and left the unemployment rate at a post pandemic high.

In addition, a further fall in employee numbers was also revealed in the data, with estimates suggesting the total number of payrolled employees fell by 32,000 in October. This drop followed a similar-sized fall in September, resulting in the largest recorded two-month decline since late 2020.

The release also showed that the annual rate of growth in employees’ average regular earnings stood at 4.6% in the third quarter. While this was in line with analysts’ expectations, it did represent a slight dip from 4.7% during the three months to August. Commenting on the month’s data as a whole, ONS Director of Economic Statistics Liz McKeown said, “Taken together, these figures point to a weakening labour market.”

Retailer and consumer sentiment both down

The latest official retail sales statistics revealed a decline in sales volumes during October, while surveys reported a drop in both retailer and consumer morale ahead of the Autumn Budget.

Data recently published by ONS showed that total retail sales volumes fell by 1.1% in October. This represents the first month-on-month sales decline since May and surprised economists with a Reuters poll predicting sales would be flat. ONS noted that supermarket, clothing and mail order sales all fell in October, which some retailers attributed to delayed spending ahead of November’s anticipated Black Friday discounts.

More recent survey data also suggests the retail environment remains tough. The headline index from last month’s GfK consumer confidence survey, for instance, fell two percentage points to -19, with the company’s consumer insights director Neil Bellamy describing November’s figures as “a bleak set of results.”

In addition, the latest CBI Distributive Trades Survey reported the steepest fall in retailer sentiment for 17 years, with November’s sales typically judged to be “poor” by seasonal norms and demand expected to remain subdued heading into December. Alpesh Paleja, the CBI’s Deputy Chief Economist, said retailers continued to grapple with “weak demand” as households remain “cautious around day-to-day spending.”

All details are correct at the time of writing (01 December 2025)

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for information only. We cannot assume legal liability for any errors or omissions it might contain. No part of this document may be reproduced in any manner without prior permission.