Commercial Property Market Review – November 2021

Business rates boost for hospitality and leisure

The Autumn Budget provided good news for badly hit shops, restaurants, bars and gyms, with a temporary 50% cut in business rates in England announced by the Chancellor.

These sectors, which suffered particularly badly during the pandemic, will be able to claim a 50% discount on their bills up to a maximum of £110,000, a tax cut worth almost £1.7bn. They weren’t the only ones to receive a financial boost though; a planned annual increase in rates for all firms was scrapped for the second consecutive year.

Mike Hughes, NAEA Propertymark Commercial Board Member, welcomed the Chancellor’s business rates announcement. He commented, “Most retail, hospitality, and leisure businesses are still fighting hard to get back on an even keel following the COVID-19 pandemic and so the certainty of continued business rates relief for these sectors is a great help. This will aid those business owners and investors looking to prepare their properties for sale and give purchasers the confidence to progress with acquisitions.”

ESG at the forefront post-COP26

A new study by Deepki has shown that more than half of the UK commercial property sector expects an increased focus on environment, social and governance (ESG) issues in the aftermath of COP26, while two thirds believe the World Green Building Council’s 2050 net-zero targets are achievable.

Many industry leaders acknowledge that the commercial property sector will play a vital role in addressing climate change, given that the built environment is currently responsible for about 40% of global carbon emissions. At COP26 in Glasgow, a panel event entitled ‘Commercial buildings: A real asset in addressing climate change?‘ discussed the obstacles and necessary action for meaningful progress and cross-sectoral action on environmental standards.

A primary challenge remains the investment needed to decarbonise commercial buildings. With almost half of respondents agreeing that retrofitting or addressing the carbon footprint of older buildings is a priority, analysts predict significant improvements could be made in the years ahead.

EPC B rating still elusive despite demand

According to Savills, more than a billion square feet of UK office stock has an EPC rating of C or below, which means 87% of buildings fall short of the proposed minimum B rating.

This target comes from a consultation held by the Department for Business, Energy and Industrial Strategy between March and June 2021, which set itself the goal of implementing a framework to ensure all non-domestic rented buildings achieve an EPC rating of at least B by 2030. The responses to the consultation are due to be published later this year.

Despite the abundance of unsustainable space, there is growing demand for buildings with high EPC standards. Indeed, Savills reports that demand for office space that can satisfy ESG credentials is currently outpacing supply.

Analysts suggest that tenants are attracted to sustainable office spaces by reputational benefits and lower energy bills, while growing demand could allow landlords who make their office stock comply with the new rules to benefit from higher occupancy rates.

| Many industry leaders acknowledge that the commercial property sector will play a vital role in addressing climate change |

Commercial property currently for sale in the UK

- Regions with the highest number of commercial properties for sale currently are South West England and London

- Northern Ireland currently has the lowest number of commercial properties for sale (23 properties)

- There are currently 1,427 commercial properties for sale in London, the average asking price is £1,594,264.

| Region | No. properties | AVG. asking price |

|---|---|---|

| London | 1,427 | £1,594,264 |

| South East England | 1,206 | £2,063,460 |

| East Midlands | 760 | £953,869 |

| East of England | 801 | £664,106 |

| North East England | 800 | £302,180 |

| North West England | 1,359 | £396,723 |

| South West England | 1,518 | £823,806 |

| West Midlands | 1,081 | £498,428 |

| Yorkshire and The Humber | 1,121 | £356,416 |

| Isle of Man | 52 | £477,082 |

| Scotland | 1,143 | £334,552 |

| Wales | 784 | £432,460 |

| Northern Ireland | 23 | £630,812 |

Source: Zoopla, data extracted 18 November 2021

Commercial property outlook

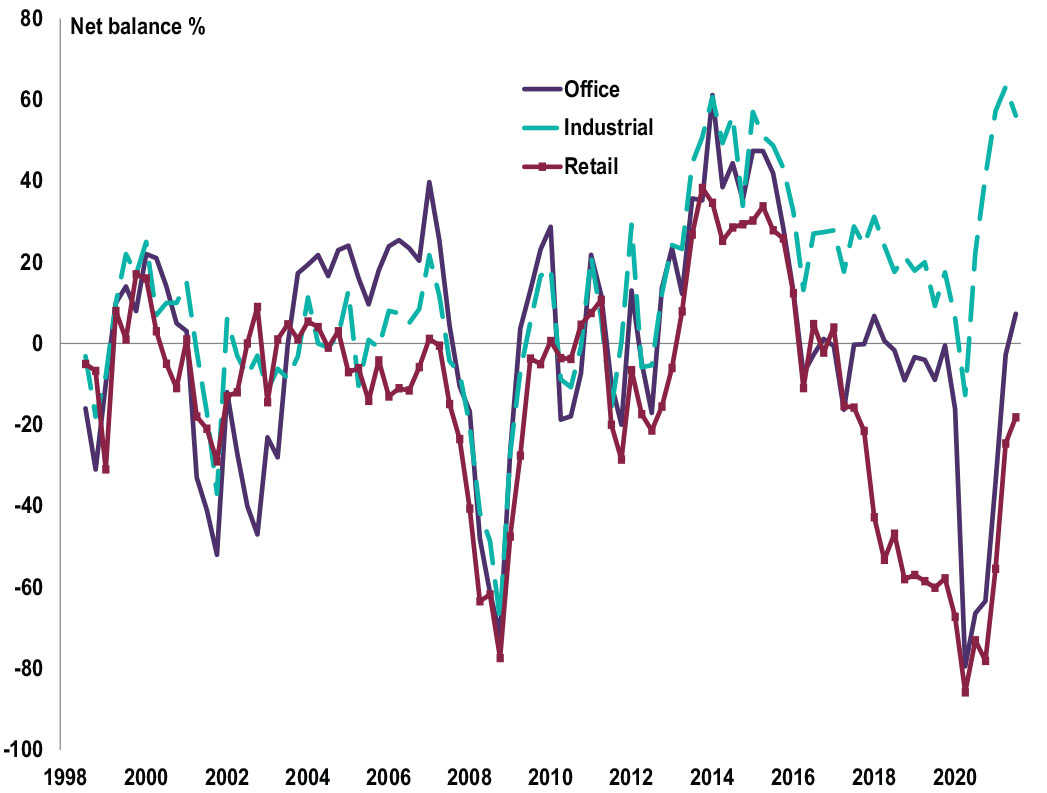

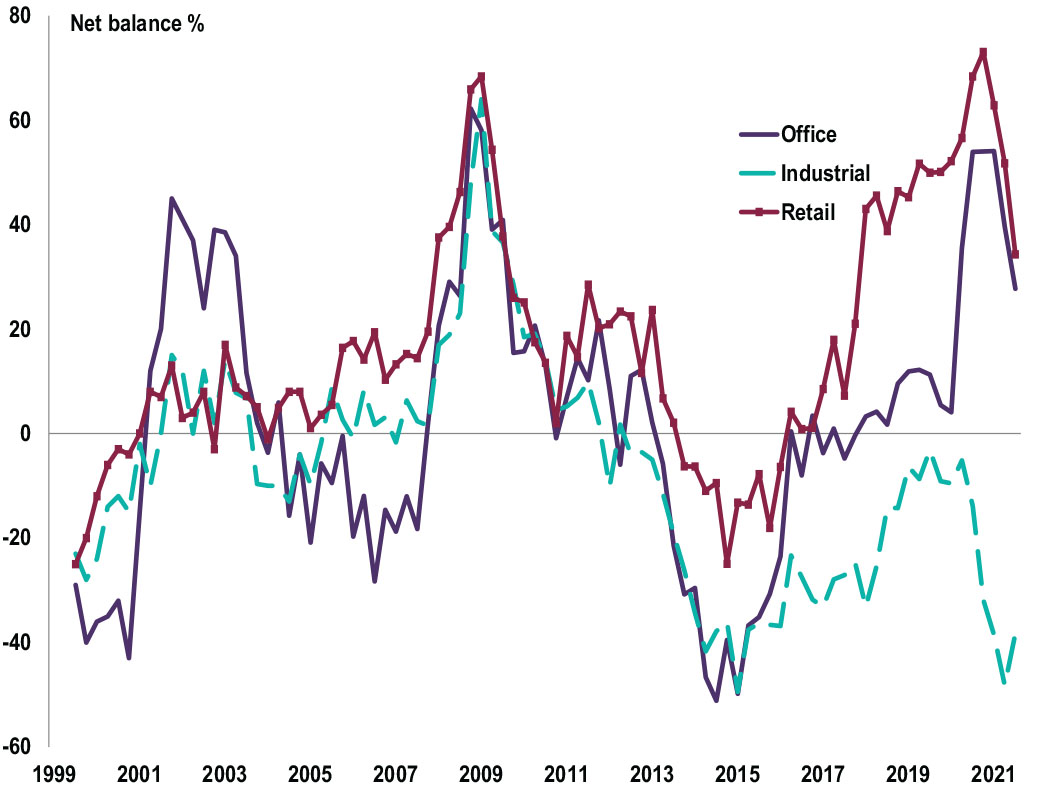

Occupier demand – broken down by sector

- A headline net balance of +18% of contributors reported a pick-up in overall tenant demand over Q3

- A net balance of +56% reported an increase in demand for industrial space

- Occupier demand for office space showed the first positive reading since early 2018 at +7%

- The retail sector remains subdued at -18%.

Source: RICS, UK Commercial Property Market Survey, Q3 2021

Availability – broken down by sector

- The supply of available industrial space remains negative, with the latest net balance standing at -38% in Q3

- Rising vacancies for office and retail continue to be seen, returning net balances of +28% and +34% respectively in Q3.

Source: RICS, UK Commercial Property Market Survey, Q3 2021

All details are correct at the time of writing (18 November 2021)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.